Together we will build a comprehensive wealth plan aiming to safeguard your family’s future, investing to fund your financial aspirations, understanding your inheritance tax situation or preparing for retirement – it all begins with a plan to suit your needs.

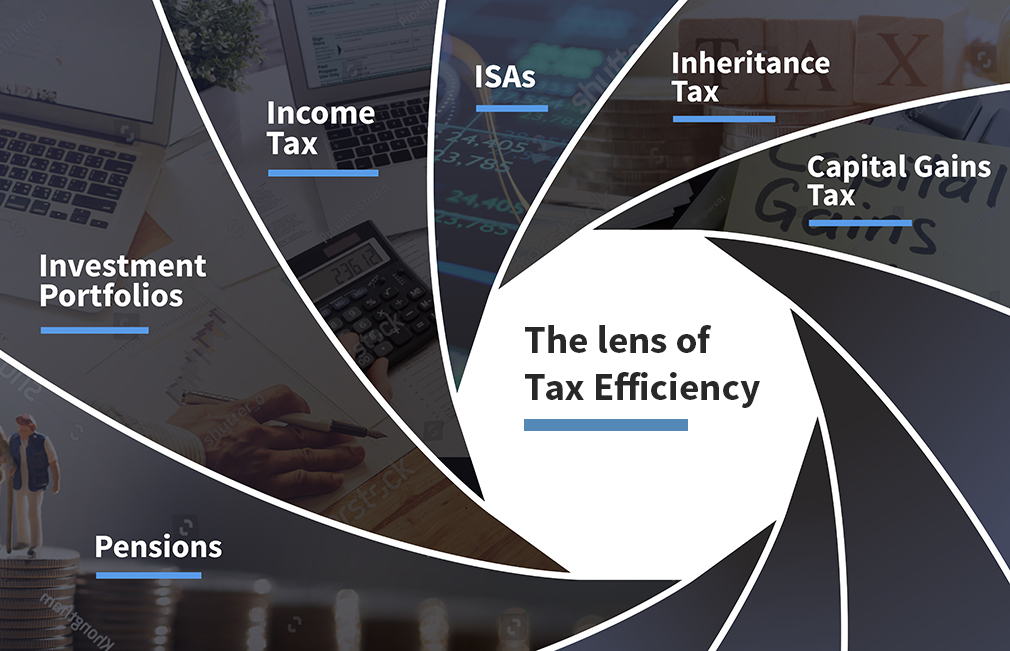

We always assess wealth and investments through a lens of tax efficiency.

As the ever-dogmatic American broadcaster Arthur Godfrey once said, “I am proud to be paying taxes in the United States. The only thing is I could be just as proud for half of the money.”